zkSync

A full research report on zkSync, one of the most awaited L2 ZK-Rollup blockchain.

Overview

zkSync is an Ethereum layer 2 chain using Zero Knowledge rollup technology to solve the current issue of Ethereum, scalability.

The chain has been developed since 2019 by Matter Labs and is now in the baby alpha phase, conducting an internal mainnet test.

Thanks to the ZK technology, zkSync should be able to process more than 20 000 TPS, becoming one of the most efficient layer 2 EVM compatible. The implementation of Layer 3 technology as well as account abstraction will bring the project to its final goal, mass adoption.

To achieve such a result, zkSync can count on the $458M raised among the most prestigious Venture Capitals and Business Angels. The team is also able to leverage its 500k + members community to meet mass adoption and conduct thorough stress tests.

Let’s take a deep dive into this exciting project and understand the impact zkSync plans to have on the crypto industry.

What we will cover:

Project presentation

Technology

Industry Overview

Value proposition

Team

Fundraising

Tokenomics

Roadmap

Ecosystem

Metrics

Pumpamentals

Community and marketing analysis

Risks

Conclusion

Project presentation:

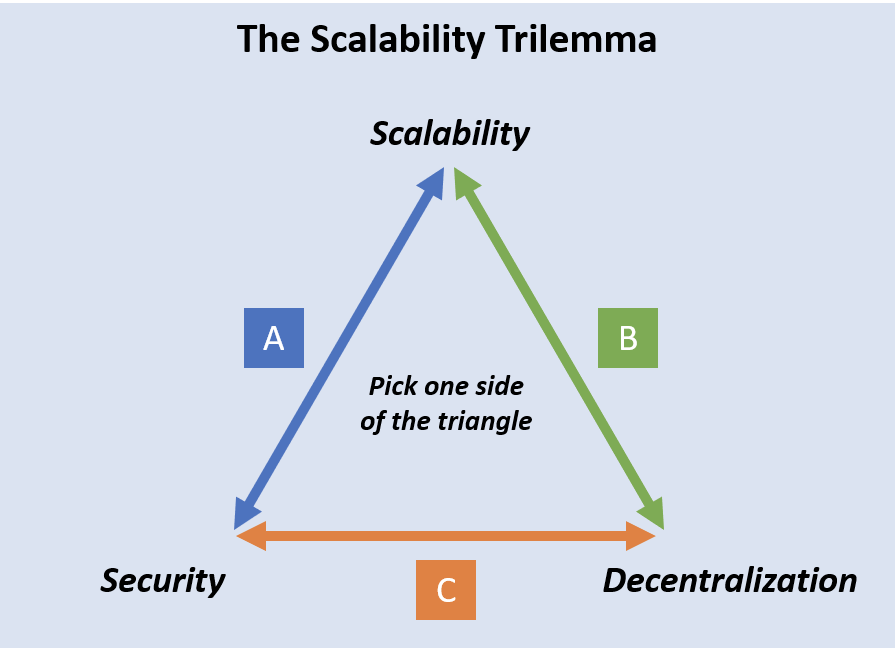

Ethereum is the most used and trusted chain in the crypto ecosystem. Thanks to its thousands of dApps and DeFi protocols, it succeeded to outpace every other chain. Ethereum is also well known for its security and decentralization but it, unfortunately, faces the common blockchain trilemma which states that only two sides can be achieved.

To solve the scalability issues (speed and transaction cost) of Ethereum, many layer 2 protocols have been built on top of the chain to try scaling it.

zkSync is one of the contenders in this race, created in 2019, it has one objective: bring mass adoption.

To do so, zkSync is using the Zero Knowledge rollup technology in order to improve transaction throughput, cost, and privacy.

Currently live on its second version, zkSync differentiates itself via multiple features such as low transaction cost (a few cents per transaction), security while benefiting from Ethereum security, and decentralization, by using the ZK SNARK technology.

zkSync also provides interoperability thanks to its V2 launched in February 2022 which allowed it to become the first EVM-compatible ZK-Rollup, an achievement that should have taken years.

The protocol isn’t fully deployed at the moment in order to continue improving and testing as much as possible the technology before going full live. The mainnet is actually in the Baby Alpha phase, a period where the team tests the chain with real assets and money.

To stand out from other chains, zkSync is focusing on 5 main Ethereum-related properties, such as:

Being a general-purpose protocol

EVM-compatibility (Supports Solidity language)

Gas payable in ETH

Open Source and decentralized

By focusing on those 5 elements, zkSync isn't only in line with the Ethereum community objectives, but with the market and cryptocurrency as a whole.

To bring innovation to the table, the chain is also looking to put in place mass adoption tools such as Account Abstraction which will reduce the onboarding complexity for users.

Layer 3 is also part of the project, a whole new way of building and communicating across chains while putting at the center privacy and scalability.

zkSync will be governed by a DAO called zkDAO that aims to promote growth in its ecosystem by providing funding for various projects and initiatives. By partnering with BitDAO, the entity will focus on 5 main areas such as:

Strategic capital provided to protocols in the ecosystem

According grants to the development of the chain and public good tools.

Research and Development to continue improving the protocol as well as the ecosystem

Education to organize events and workshops to raise awareness about the ZK technology

Security to constantly implement the highest standards in the ecosystem

Attracting and retaining users in the ecosystem will be one of the key growth challenges for zkSync where the experience of BitDAO will be greatly appreciated.

The next key challenge will be the implementation and development of the Zero Knowledge technology, so let’s dive into it.

Technology:

zkSync succeeded in attracting attention by implementing and developing cutting-edge mechanisms. The chain's major innovation remains the use of Zero Knowledge technology combined with the rollup function. It grants greater security and efficiency compared to other L2 technologies, forecasting a performance of more than 3,000 TPS.

Reaching mass adoption remains complicated due to the actual UX/UI and onboarding issues. The chain had to improve the process by implementing account abstraction that grants many perks such as improving the user experience. Account Abstraction makes it easier to manage onboarding and wallet creation by getting email-like connections. Users' experience will also be improved by having improved transaction processes and routes as the image below describes.

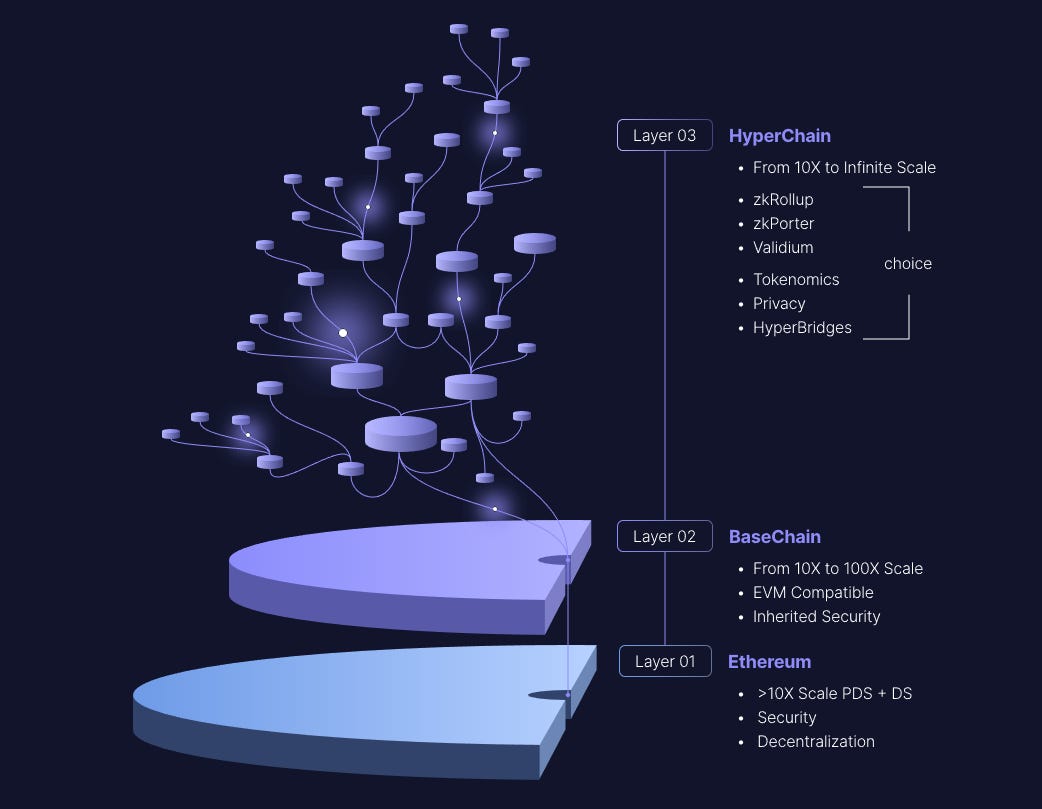

To go further, zkSync will develop layer 3 or “fractal hyperchains” aiming to scale L2 and provide new functionalities such as privacy and anti-MEV transactions.

Each L3 will have native and secured bridges (which is the cause of billions of hacks per year). The possibilities of scalability become infinite for the blockchain while keeping the security of the underlying chains.

The main challenge with ZK rollups is to become EVM compatible, meaning developers can communicate and develop in similar conditions as if it was on Ethereum main chain. EVM was considered impossible to achieve before many years of development, but in 2022, zkSync released the first type 4 ZK EVM compatible rollup with 99% compatibility using Yul and Zinc compilers.

Once the compilers are finished, they plan to focus on making Zinc more expressive and feature-rich and then building a Rust compiler to allow programming smart contracts using native Rust.

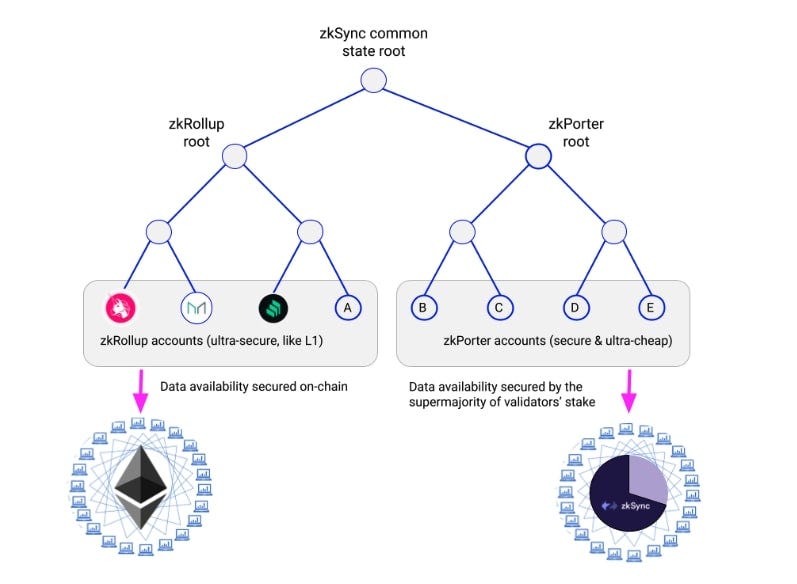

zkSync developed what can be considered as THE major innovation, ZKPorter, a function that will allow users and developers to choose between validity rollup (on-chain data availability) and validium (off-chain data availability). This allows each project to select the format they prefer with their needs, as an example, a gaming project might not require to have the same security level compared to a DeFi project and choose validium instead of validity.

By definition, zkPorter will become much more efficient than Optimistic and zkRollups as their data are stored off-chain and do not require to be transacted on Ethereum. The protocol’s stakeholders will be invited by the protocol to run a form of Proof of Stake consensus and form a group called Guardians. This will tremendously reduce the transaction fees made on zkPorter and allows up to a forecasted 20k+ TPS!

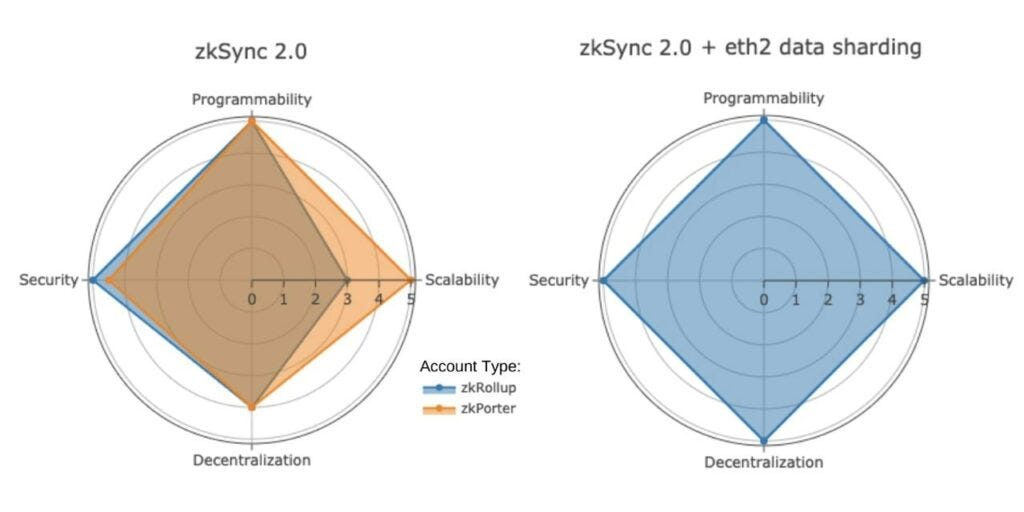

We mentioned earlier the concept of the blockchain trilemma, which states that it is difficult to achieve scalability, security, and decentralization at the same time. However, when it comes to scaling Ethereum, there is another important aspect to consider according to zkSync: programmability.

Programmability refers to the possibility and easiness to code and create smart contracts, and as a consequence, developing dApps and the ecosystem.

All current scaling solutions trade off some degree of security, decentralization, and programmability for scalability while zkSync 2.0 aims to overcome this trade-off by utilizing ZKporter and zkEVM to attain full scalability.

Industry overview:

To face the issues faced by Ethereum, many projects are trying to bring scalability to the chain. L2Beats lists more than 10 different layer 2 blockchains, ranging from a few thousand dollars of TVL to more than 2 billion.

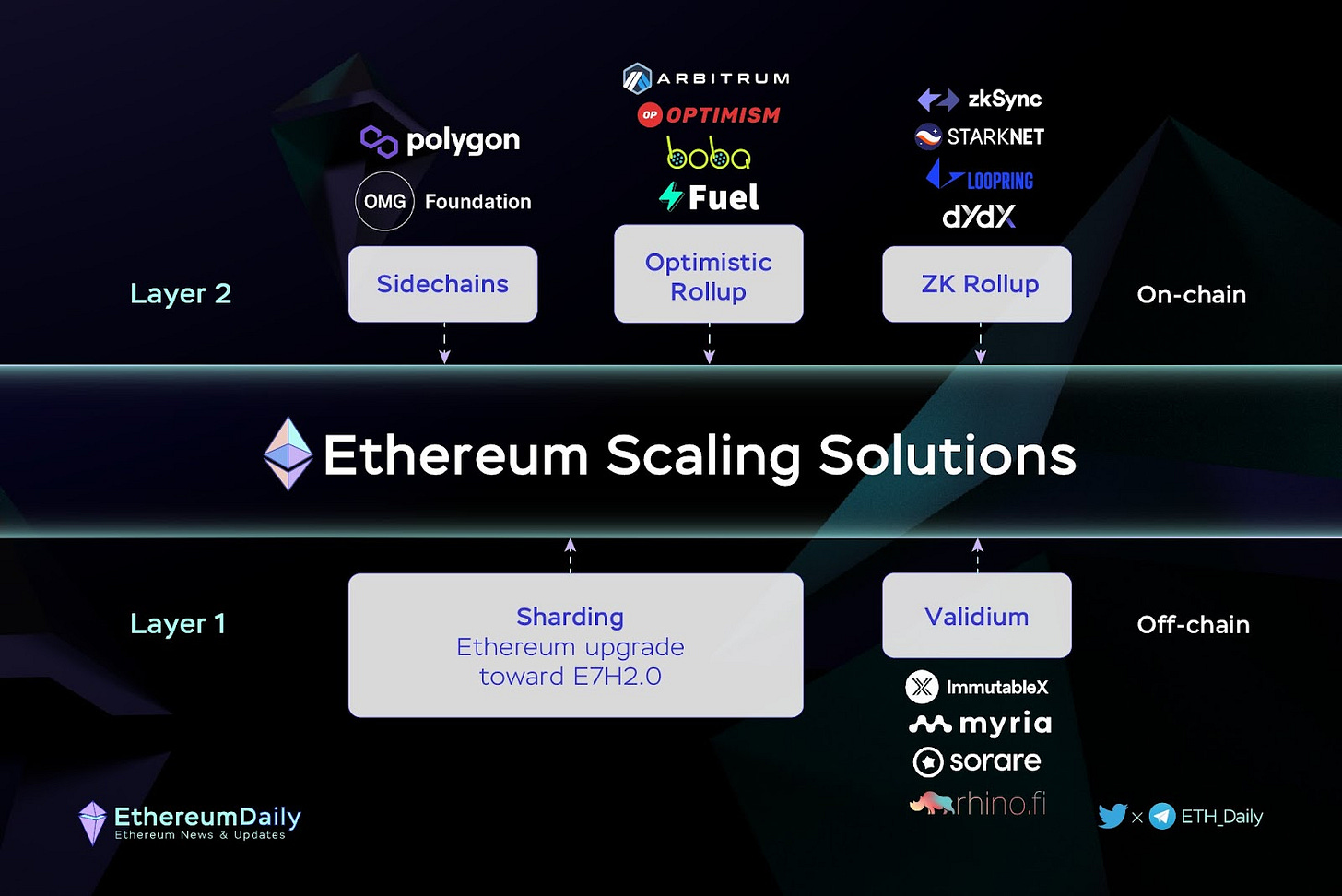

There are several Ethereum layer 2 solutions and technologies that have gained significant traction in the ecosystem, each with its own unique set of trade-offs and use cases.

Some of the most important ones include:

Optimistic Rollup: It works by batching transactions off-chain, and then periodically publishing the results on-chain allowing for fast and cheap transactions, trading off the security and decentralization level since it always assumes transactions are valid (optimistic). In addition, transactions go through a 7-day latency before being validated. The main chains are Optimism ($1,7B TVL) and Arbitrum ($2,7B TVL)

ZK-Rollup: It works by allowing users to create and publish Zero Knowledge proofs of their transactions, which can be verified by smart contracts on the Ethereum main chain. zk-Rollups allows greater privacy, scalability, and transaction cost, but faces risk due to its relatively new deployment and complexity. The main projects are zkSync ($64M TVL), Starknet ($7M TVL), Loopring ($108M TVL), and Polygon Hermez.

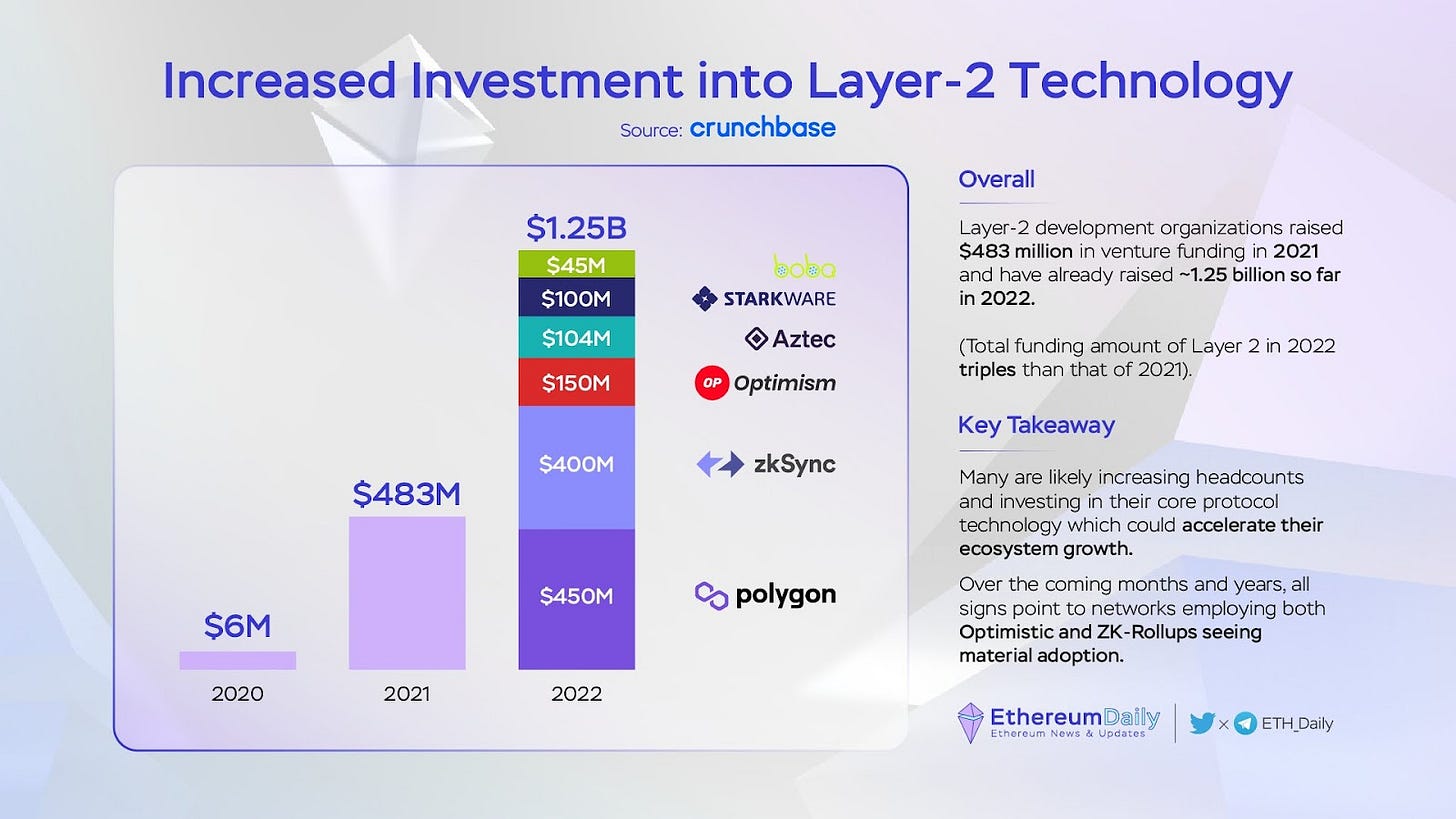

This enthusiasm is not only shown by builders and users but also by large investors. In 2022, investments made on Layer 2 grew by more than 150%, reaching $1,25B.

Blockchains are benefiting large valuations and fundraisings due to the major issues they aim to solve and the financial opportunities it opens.

Seeing all the existing technologies and incoming ones such as Scroll, Taiko, and more, zkSync will have to constantly deliver valuable innovations and tools in order to keep its advantage.

Value proposition:

The Ethereum Blockchain has proven its necessity over the years in the crypto industry, by being one of the most secure and decentralized chain.

The question being raised is whether Zero Knowledge proof systems, such as zkSync, can be relied on as a long-term solution for Ethereum transactions.

Well, zkSync has shown increased efficiency, seamless transactions, and lower costs for DApps.

As mentioned above, the Layer 2 ecosystem is large and has multiple competitors that already have existing adoption and large resources. To differentiate itself from other scaling solutions, zkSync provides multiple innovations that enhance users' experience and ecosystem technology.

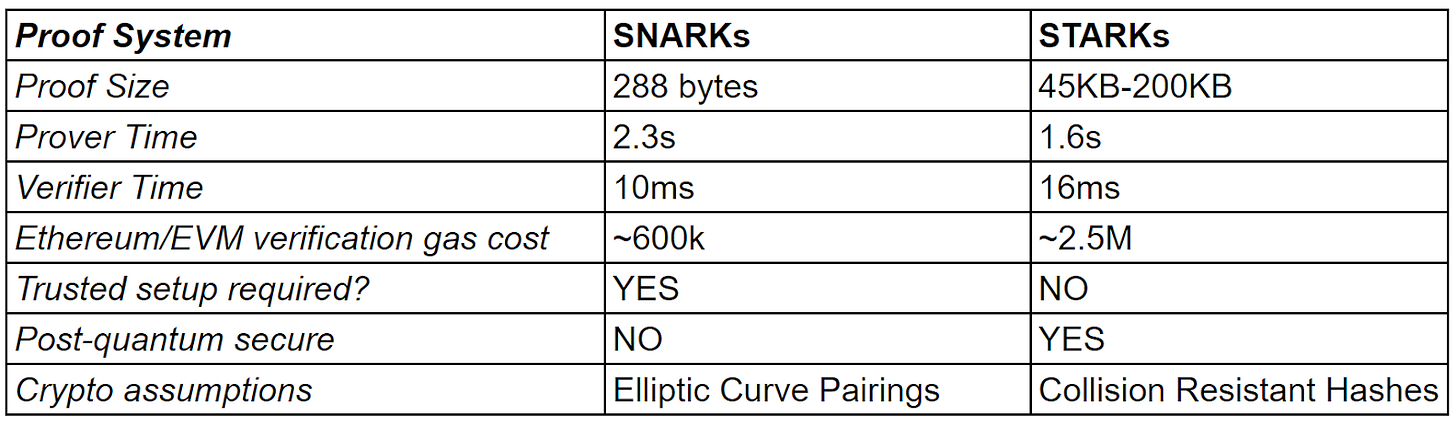

Using Zero-Knowledge technology is one of them, the SNARK rollup technology was selected by zkSync thanks to their better backtesting over STARKs.

As the graph shows, SNARKs are faster (verifier time) and cheaper (verification gas cost) than STARKs, requiring less computational power than computing the hashing functions used by STARKs.

As a matter of fact, Zero Knowledge technologies provide greater privacy by verifying information without revealing the underlying data. This allows private transactions while still maintaining security and protecting the user's identity.

To stay in line with Ethereum values, zkSync announced that the transaction fees will be payable in ETH while also supporting any other tokens that will be converted to pay the transaction fee.

To go even further in line with Ethereum and the Blockchain values, zkSync is aiming to become completely decentralized once the chain will be able to run without any third party. At that time, Matter Labs, the company behind zkSync, will hand over the protocol to the Validators and Guardians.

Composability is another important feature of zkSync since it allows applications to build and exchange on top of one another. This implementation isn’t yet available for zkRollups while being highly required for chain development.

Team:

Matter Labs, the company behind zkSync is based in Germany and was launched in 2018 by Alex Gluchowski which quickly grew to more than 50 employees. The team is composed of experienced blockchain developers, researchers, and entrepreneurs who have come together to create a more efficient, cost-effective, and secure way to transact on Ethereum.

CEO: Alex Gluchowski. Has more than 15 years in development and evolving as a CTO and entrepreneur. He is passionate about individual freedom, self-ownership, and decentralization.

COO: Zoe Gadsden. Ex Google, Zoe has 10 years+ as a growth and product lead

CFO: Ankur Rakshit. Previous experience with 15 years in finance and a previous role as head of Financial Planning and Analysis at Kraken.

CPO: Steve Newcomb. A successful entrepreneur and product manager with more than 15 years of experience in the sector and accelerator programs.

Lead Marketing and communications: Shazia Hasan. Has various experiences in finance and communication during the previous years

Thanks to the diverse backgrounds, the team is able to navigate through multiple key aspects of building a blockchain and running a company. Those are really important points since the project has the objective of becoming massively adopted.

The capacity of the team to ship is undeniable and they can count on their experience to deliver constant innovations.

Fundraising:

Since 2018, zkSync has had the opportunity to raise funds through 5 funding rounds. Totalizing $258M raised from the biggest investors, Venture Capitals, and investment firms plus $200M of funding commitment from BitDAO.

Such an amount guarantees enough funds to develop the project and infrastructure as well as being the largest funded layer 2.

The notorious raises were:

Series C round for $200M in November 2022 led by Dragonfly and Blockchain Capital

A 200M commitment funding from BitDAO in January 2022

Series B round for $50M in November 2021 led by a16z

Series A round for $6M in February 2021 led by Union Square Ventures

A seed round for $2M in September 2019 led by Placeholder

Something interesting is that multiple VCs and investors repeated their investments during the next rounds, showing a real attraction for the project.

The $200M funding from BitDAO will be used to bootstrap the zkSync ecosystem and be released in 5 tranches of $40M while reaching specific milestones. (more in the Ecosystem section)

As a result, zkSync now has massive funds that will help them develop multiple important points such as growing the teams, developing the ecosystem, attracting protocols, users, and creating the Matter university, a learning hub.

The team has clearly enough cash available to cover their burn rate and present the first product development. It is also important to note that a major part of the fund raised will be used to develop the ecosystem, and allocate grants to onboard developers and users.

Tokenomics:

As of today, zkSync does not have released any information on their token and tokenomics which fuels user and investors' speculations.

From what the team claimed, only 30% of the tokens will be allocated to the team and investors while the rest will be used for the community and ecosystem development

It is thus rational to expect an airdrop to early adopters and consistent community members. Airdropping has become a regular strategy from largely funded projects to onboard and attract users.

Indeed, airdrop hunters help the project by bringing TVL and activity on the chain, which results in rapid development. As a result, zkSync should be surfing on the airdrop wave and leaving an aura of doubt in the community such as what Arbitrum is currently doing

Even if the team has announced that gas fees will be payable in ETH, we can imagine multiple utilities to the future token:

Getting used for gas and converted into ETH

Granting governance over the protocol and DAO

Getting staked or delegated to validate the transactions to become a Guardian

Overall, it becomes clear that a token will be released due to the numerous investors and backers zkSync onboarded over the past years, the only remaining question is when and under which criteria.

Roadmap:

In terms of roadmap, the team is continuing to deliver constant and solid innovation to the community which led to some crucial phases such as the bridge from testnet to mainnet development.

The Baby Alpha was released in late October 2022 which helped the team to stress-test with real-money scenarios and ensure it is performing as expected.

The next step, the Fair Onboarding Alpha, is planned for Q1 2023 and will consist of welcoming all the ecosystem projects in a user-closed beta. This phase aims to implement a completely working system while postponing the performance and cost optimizations. The team will, in the meantime, develop SDKs, and block explorers in parallel with bug bounties or documentation improvement.

The most awaited step is the Full Launch alpha, which should arrive in Q2 2023 with the validation of the previous phases. Once the security audits, contests, and bug bounties are completed and ecosystem projects have been fully tested on the system, zkSync 2.0 will be open for all users. At this stage, zkSync 2.0 will be available for all projects and users and improve TPS performance to at least an order of magnitude higher than Ethereum.

Overall, 2023 will be similar to 2022 for the team, a crazy bunch of new development and key implementations will be run throughout the year which should lead to a complete working chain by the end of the year.

Ecosystem:

As mentioned above, zkSync is not yet fully launched but still has projects and protocols that are deployed on the chain.

Matter Labs claims that more than 150 projects have already deployed or are willing to deploy on the chain. Those first movers brought a TVL of $65M while most of the apps are still not yet live on the mainnet.

Having such a quantity of apps deploying on the mainnet would make the “big bang” from zkSync the largest layer 2 launch in history, helping once again to bring mass adoption to the chain.

Attracting major protocols such as Uniswap, AAVE, Curve etc should not be a problem regarding the mass adoption potential of the chain and the cash ready to be deployed by the team to attract such protocols.

The $200M funding commitment from BitDAO will play a major role in the ecosystem development. The DAO is dedicated to expanding the zkSync ecosystem through active funding in various areas:

70% of funds will be used for strategic capital investments in areas such as DeFi, NFTs, games, privacy, interoperability, and even providing liquidity.

7.5% of funds will be allocated towards grants for the development of tools that migrate from L1 to L2, in order to speed up adoption and encourage industry players to invest and research further.

7.5% of funds will be used to fund retainers with security audit firms to ensure the security of the ecosystem and create knowledge and standards for security.

5% of funds will be allocated to R&D to improve zkProofs and related technologies

5% of funds will be allocated to education and training on the opportunities provided by the technology and its implications

5% of funds will be used for operations such as legal setup, compliance, and payroll.

The investments will be selected by the decision committee based on the goals and objectives that were settled up during the first phase. These milestones may include the number of investments made, grants awarded, the impact of the public goods funded, contributions to the DAO's core tools, and any other metrics that the Steering Committee and Funding Team decide to include.

Wisely managing the investments and cash spending will be crucial for zkSync as it will without a doubt spend a lot on acquiring users, driving growth, and reaching mass adoption before becoming self-sustaining (which was the strategy employed by Polygon).

Metrics:

Even if zkSync isn’t yet fully deployed and operating at its optimal capacities, the recent updates allowed users to bridge real money and start testing the chain.

More than $60M have been bridged on the rollup with some spikes to more than $150M in the last months, resulting in 800k + transactions made by 400K + unique users since its development.

The full alpha launch promises a major value bridged to the chain as the 150 protocols will be launched at the same time. To manage such development and forecasted activity, Mysten Labs is actively working towards onboarding developers and increasing the number of commits.

The strategy seems to start bearing fruits as the number of active developers and weekly commits on Mysten Labs has been steadily growing over the past years even if the bear market and recent Bankruptcies have most likely taken away some developers.

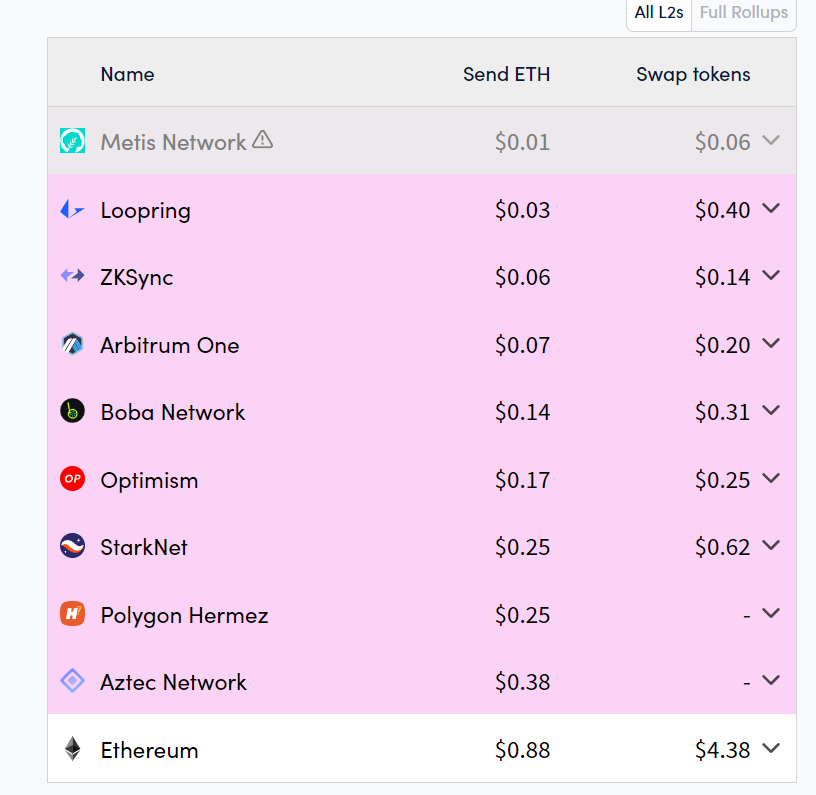

Even though zkSync is not yet operating at its full capacity, the transactions made on the mainnet by users show impressive results in terms of costs, being more efficient than multiple Billion dollar optimistic rollups for ETH transfers.

Regarding the swap functions, zkSync is the second cheapest solution live on the market, granting thrilling results once fully developed.

Pumpamentals:

In order to strive in the market and embrace adoption, zkSync will need to provide and develop what I call “pumpamentals”. This term is basically made to discern the narratives and plays that a project should be able to surf on.

Let’s resume which narratives zkSync should be able to leverage and get a competitive advantage.

First and foremost, the Layer 2 narrative is a major one. Ethereum is facing critical issues in terms of transaction speed and cost. We all remember some swaps and mints costing hundreds of dollars during the last bull. Layer 2 rollups are at the moment the hottest rollups on the market with multiple existing chains such as Arbitrum, Optimism, Metis, etc.

Value is constantly flowing towards L2s, even during hard times such as the bear market.

Zero Knowledge proofs are awaited by the community in order to provide better security, scalability, and cost to the users compared to the optimistic rollups. Most of the biggest investment funds and experts are perceiving Zero Knowledge as a major progress in the blockchain ecosystem, resulting in huge fundraisings and attention from investors.

zkRollups also have the advantage of becoming cheaper to use as more users transact on the network, in contrast to traditional blockchains which get more expensive with increased usage.

EVM compatibility becomes a must-have for every blockchain since more than 60% of the total TVL is on Ethereum which forces projects to have compatibility with the chain if they want to attract users, developers, and TVL. By having major protocols on the chain, its adoption and development will happen much faster than without any incentives or on-ramp ease.

The $458M of financing that zkSync received will have a large impact on the chances to develop itself and reach mass adoption. By being the largest funded chain, zkSync gets an important competitive advantage over its competitors, and as usual, cash is king.

As with every company and project, being the first to launch gives the most chances to succeed. zkSync is actually one of the most advanced ZK technology and will potentially get released completely in Q2 2023.

We mentioned earlier the influence of airdrops and rumors among hunting communities. Optimism and Aptos have been the current major examples of growth and TVL attraction airdrops can bring. However, it is quite complicated to analyze precisely the effects of airdrop rumors.

zkSync has many narratives and possibilities for developing itself, the crypto industry remains young, and surfing on trends and arcs is one of the most important competencies a project can have.

Community and marketing analysis:

To strive within the Layer 2 market, projects need thorough communication strategies and implement narratives as soon as possible.

Markets are irrational and the direct result of such irrationality can be perceived in the top market cap projects where disparities are spotted among the top 10 based on the fundamentals and innovations they bring to the industry. The leaderboard showcases tokens that, from a purely fundamental point of view, should not be among this ranking. However, they’re here.

This precise point shows that fundamentals are important in a project, but communication, narrative, and in the end, the community, are the most important.

We saw earlier that the fundamentals of zkSync are strong and provide a lot of value to the ecosystem, it’s now time to see how they’re building their communication strategy, and especially the community.

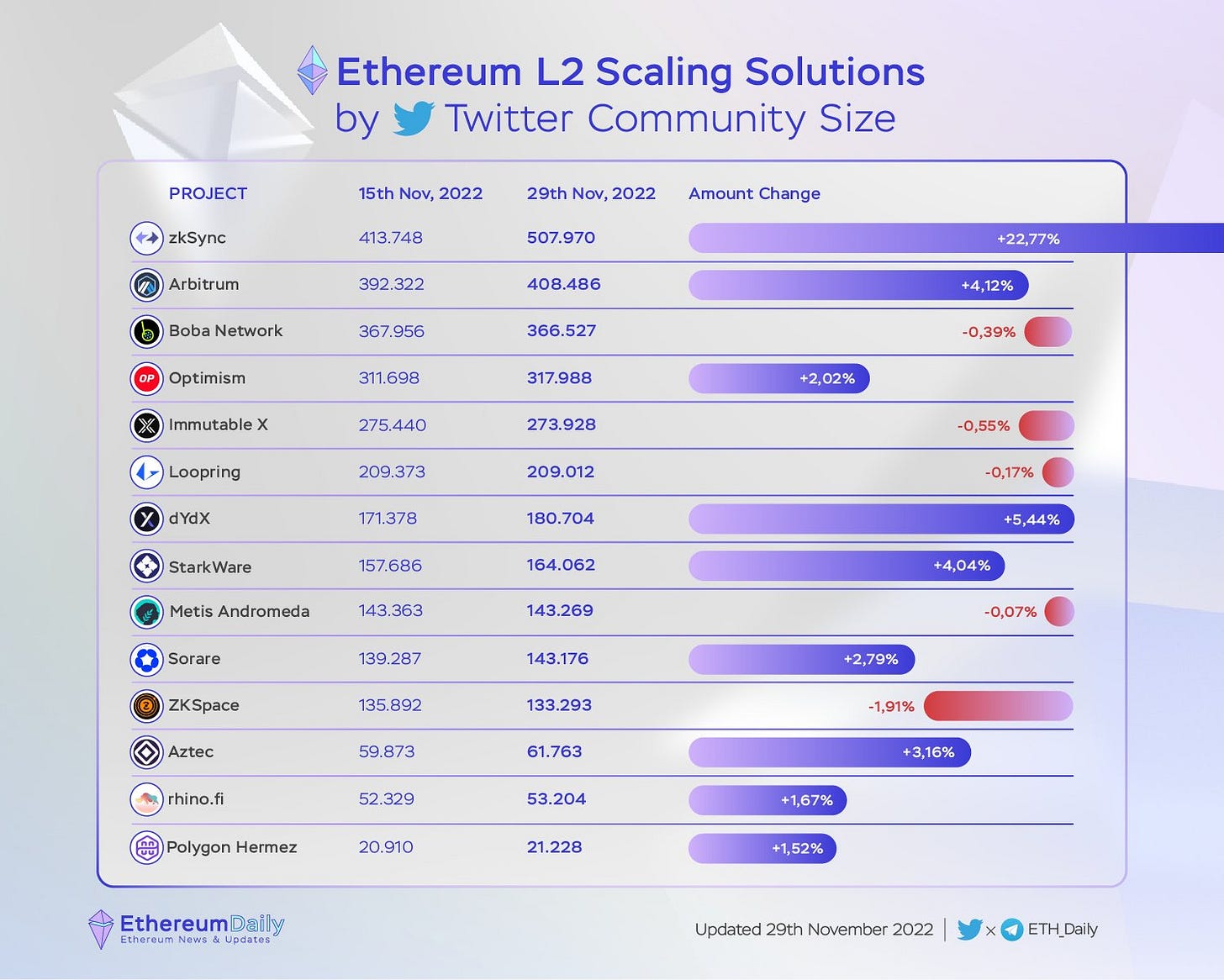

While analyzing the social media and statistics from November, zkSync had one of the biggest following on its Twitter account with more than 500k.

zkSync is thus the most followed Layer 2 in the market, when we take a look at how and when those followers have been attracted, we see some interesting figures.

As the graph shows, zkSync earned more than 60k followers in the sole week of late October which was the period when they released their baby alpha update.

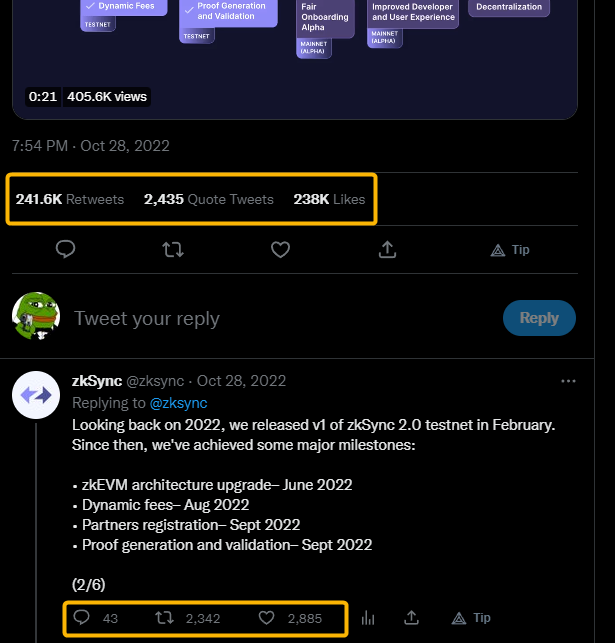

Those numbers are quite disturbing if we take a deeper look at the announcement message, which got more RTs than likes and has a huge disparity in engagement between the first and second tweets.

Other tweets posted the same day have 200 times less engagement than the announcement one.

Even if pumping the engagement and followers seems to become a standard in the industry, the marketing agency hired to execute the communication strategy might have gone a bit too far with the numbers.

In the meantime, it’s undeniable that zkSync acquired a large community and strong brand awareness thanks to the multiple apparitions in AMA sessions, spaces, and events.

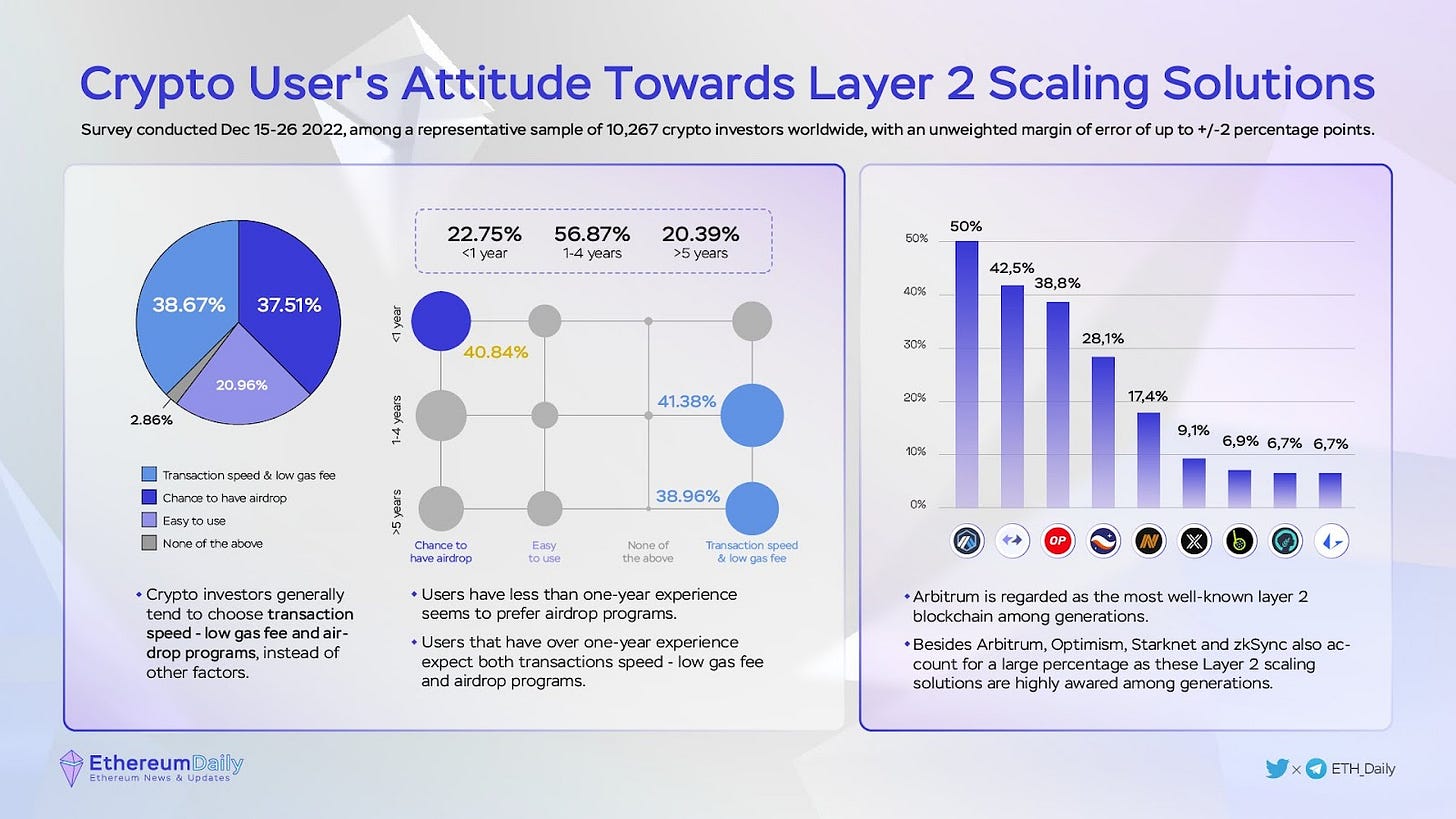

Ethereum daily has recently released a survey on the most well-known layer 2 and the users’ attitudes regarding them. Due to the recent narrative and the Arbitrum season, the chain ranks first as the most well-known among the investors while zkSync comes second, before Optimism which has more than 1 Billion TVL and millions of users.

A pretty impressive score when we consider that zkSync isn’t yet in full mainnet and has a TVL of only $60M.

Recent users seem to be more interested in financial opportunities while the more experienced seem to be here for the tech. A complex and important marketing strategy will have to be managed to convince and attract both communities as zkSync is aiming for mass adoption.

Regarding the other social platforms, zkSync has 300k + members on their discord that can earn specific roles through their engagement. The protocol also runs a crew3 round that can help users discover the chain and the main features through quizzes. A Guild campaign is live but will mostly start when the ecosystem will grow and protocols develop on the chain.

Matter labs are also partnering with on-site events such as ETH Denver that combine their alignment with the eth community as well as growing its presence in physical events, a place where builders and investors often meet.

Marketing and communication are crucial for a crypto project, the market immaturity does not reward yet the most innovative or performant project solely, but the ones that mix innovation and communication. By relying on complex technologies, zkSync will have to implement thorough education materials as well as UX/UI in order to onboard the masses, thankfully, the large funding should help a lot on this point.

Risks:

That being said, there are a few factors that could potentially impact the adoption and success of zkSync:

Zero Knowledge technology is still young on the blockchain and hasn’t been back-tested for as long as traditional verification technologies. It relies on complex mathematical assumptions and cryptographic techniques, which can make them vulnerable to attacks if any of these assumptions are broken or if there are errors in its implementation. The difficulty to understand ZK-Rollups can also make them less accessible to the average user and limit their adoption.

SNARKs are not quantum resistant, less scalable, secure, and transparent than STARKs.

The EVM compatibility is made at the language level, meaning that it goes from Solidity to a SNARK Virtual Machine. Due to the process, it adds risk on the compiler side. The EVM focus also has constraints regarding scaling and development of mainstream activity which could be done through other types of VM.

Communication and marketing require particular attention in order to deliver the value awaited as well as onboarding users. The desire of zkSync to bring mass adoption is ambitious and will require a genuine strategy as the technology and concept are quite complex.

The competition will be fierce with the other layer 2 and Zero Knowledge blockchains such as Starknet, Scroll, and Polygon, which have either better technology, security, scalability, or adoption than zkSync.

Regulation risks due to the privacy ZK technologies offer. Monero has been delisted from many exchanges and the tornado cash developer, Alexey Pertsev, has been jailed for his privacy-centric protocol. Collaboration and education will have to be made with regulators to ensure the operating possibilities of ZK technologies.

In order to become a leader, zkSync will have to face many challenges in two main sectors, technology, and communication. What made the chain stand out from the competition will also be its major challenge to overcome. Those risks and threats are certainly the reason for raising $458M from leaders in the market.

Conclusion:

zkSync has a noble objective and bringing mass adoption to the blockchain ecosystem is now one of the biggest necessities. With great power comes great responsibility, the highest capitalized blockchain will have to wisely use its funds to attract and onboard as smoothly as possible the desired communities.

Matter Labs is focused on developing a blockchain system that is not only able to handle a large number of transactions but also prepared to meet the needs of a significant number of users. Their solution, zkSync, promises to provide trustlessness, confidentiality, and speed.

The major innovations and value propositions will greatly help the team to solve the current challenges for mass adoption which are the complex onboarding through account abstraction, and the scalability, transaction cost, and speed that will be solved by the Zero Knowledge and Layer 3 technologies.

The team is composed of experienced developers, researchers, and entrepreneurs who have come together to create a more efficient, cost-effective, and secure way to use the Ethereum blockchain. The technology is still in its early stages, but the progress that has been made so far is promising, and with the support of the Ethereum community, zkSync has the potential to be a major player in the blockchain space.

Nevertheless, the race for layer 2 and Zero Knowledge development will grant major innovations and twists, for the best pleasure of the tech enjoyoors.

To be continued…

If you enjoyed this presentation, please give me a follow on Twitter for more similar content: https://twitter.com/Louround_

Disclaimer:

I do not hold any zkSync equity or tokens, neither am involved in the team and operations. This analysis has been made from a factual point of view.

The information is intended for general informational purposes only and does not constitute investment advice.

Some information in this article can contain errors or inaccuracies, but I’m always glad to discuss and learn from experts.

Dont trust, verify

Useful links:

Website: https://zkSync.io/

Twitter: https://twitter.com/zkSync

Medium: https://blog.matter-labs.io/

Discord: https://discord.com/invite/saq6fs7

Reddit: https://www.reddit.com/r/zkSync/

Gitbook: https://v2-docs.zkSync.io/dev/

Github: https://github.com/matter-labs

List of the projects on the chain: https://ecosystem.zkSync.io/

List of available tokens on the chain: https://zkscan.io/explorer/tokens/

Tutorial to dev on the chain: https://v2-docs.zkSync.io/dev/tutorials/

Team on Linkedin: https://www.linkedin.com/search/results/people/?currentCompany=["77279407"]&origin=COMPANY_PAGE_CANNED_SEARCH&sid=PK

Steve Newcomb onboarding: https://blog.matter-labs.io/welcome-steve-newcomb-matter-labs-chief-product-officer-a21c4fbf31d2

Ankur Rakshit onboarding: https://blog.matter-labs.io/welcome-ankur-rakshit-matter-labs-chief-financial-officer-ac8f0a67b7cd

zkSync 2.0 Portal: https://portal.zkSync.io/

Mainnet Block Explorer: https://explorer.zkSync.io/

Testnet Block Explorer: https://goerli.explorer.zkSync.io/

zkSync 2.0 Testnet Applications: https://matterlabs.notion.site/zkSync-2-0-Testnet-Applications-e38328bccda7472793024a25e26a1cac

Network Status https://uptime.com/s/zkSync-testnet

zkSync Packages info: https://zkSync-packages.netlify.app/

zkSync DAO: https://zkdao.io/

Nice one!